Assess and Manage Risks with MindSnap's Risk Analysis Feature

Assess and Manage Risks with MindSnap's Risk Analysis Feature

Effective risk management requires identifying potential threats and opportunities before they impact your objectives. MindSnap's Risk Analysis feature automatically analyzes content to identify risks, assess their potential impact, and suggest mitigation strategies, helping you make informed decisions and protect your interests.

What is the Risk Analysis Feature?

MindSnap's Risk Analysis feature uses advanced AI to analyze content and identify potential risks, threats, and opportunities, organizing them into structured risk assessments with impact analysis and mitigation strategies. This creates comprehensive risk management frameworks that help you anticipate challenges and capitalize on opportunities.

Key Characteristics of Risk Analysis Mind Maps

- Risk Identification: Comprehensive identification of potential threats and opportunities

- Impact Assessment: Analysis of potential consequences and effects

- Probability Evaluation: Assessment of likelihood and frequency

- Mitigation Strategies: Specific actions to reduce risks and capitalize on opportunities

- Monitoring Framework: Systems for ongoing risk tracking and management

Why Use Risk Analysis?

Proactive Management

Identify and address risks before they become problems, reducing potential negative impacts.

Opportunity Recognition

Discover and capitalize on opportunities that might otherwise be overlooked.

Informed Decision Making

Make better decisions by understanding the full spectrum of potential outcomes.

Resource Protection

Protect investments, projects, and objectives by anticipating and managing threats.

Perfect Use Cases for Risk Analysis

Business and Strategic Planning

- Strategic Risk Assessment: Evaluate risks to business strategy and objectives

- Market Risk Analysis: Assess market volatility, competition, and economic factors

- Operational Risk Management: Identify risks to business operations and processes

- Financial Risk Assessment: Analyze financial risks and investment opportunities

- Regulatory Compliance: Assess compliance risks and regulatory changes

Project and Program Management

- Project Risk Management: Identify and manage project-specific risks

- Program Risk Assessment: Evaluate risks across multiple related projects

- Resource Risk Analysis: Assess risks to resource availability and allocation

- Timeline Risk Management: Identify and manage schedule-related risks

- Quality Risk Assessment: Evaluate risks to project quality and deliverables

Investment and Financial Planning

- Investment Risk Analysis: Assess risks and opportunities in investment decisions

- Portfolio Risk Management: Evaluate risks across investment portfolios

- Market Risk Assessment: Analyze market volatility and economic risks

- Credit Risk Analysis: Evaluate credit and counterparty risks

- Liquidity Risk Management: Assess liquidity and cash flow risks

How to Use MindSnap's Risk Analysis Feature

Step 1: Select Your Content

Choose content that involves risk or uncertainty:

- Project Plans: Project documentation with potential risks and challenges

- Business Strategies: Strategic plans with market and operational risks

- Investment Analysis: Financial analysis with risk assessments

- Market Research: Market studies with competitive and economic risks

- Policy Documents: Regulatory and compliance information with risk implications

Step 2: Generate Your Risk Analysis

- Navigate to the content you want to analyze

- Right-click and select "MindSnap" from the context menu

- Choose "Risk Analysis" from the AI features list

- Wait while MindSnap analyzes your content

- Review your generated risk assessment

Step 3: Implement Risk Management

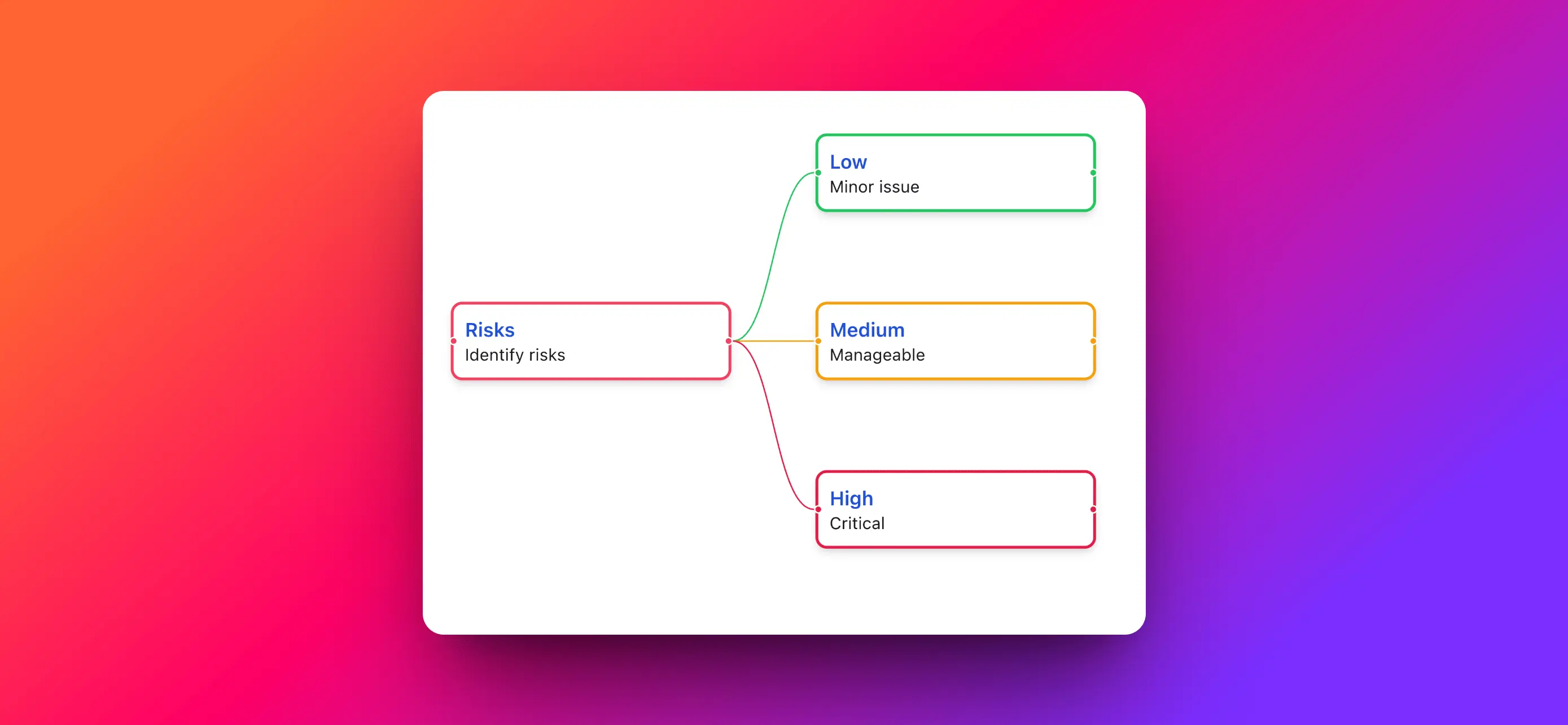

Your risk analysis mind map will display:

- Risk Categories: Different types of risks organized by category

- Risk Descriptions: Specific risks with detailed descriptions

- Impact Assessment: Potential consequences and effects

- Probability Evaluation: Likelihood and frequency of occurrence

- Mitigation Strategies: Specific actions to manage risks

Advanced Risk Analysis Techniques

Comprehensive Risk Assessment

Create detailed risk analyses by:

- Risk Categorization: Organize risks by type, source, and impact

- Impact Analysis: Assess potential consequences and effects

- Probability Assessment: Evaluate likelihood and frequency

- Mitigation Planning: Develop specific risk management strategies

- Monitoring Systems: Create frameworks for ongoing risk tracking

Customized Risk Analysis Types

Adjust your analysis based on your needs:

- Strategic Risk Analysis: Focus on high-level business and strategic risks

- Operational Risk Analysis: Emphasize day-to-day operational risks

- Financial Risk Analysis: Concentrate on financial and investment risks

- Project Risk Analysis: Detail project-specific risks and mitigation

- Compliance Risk Analysis: Focus on regulatory and compliance risks

Integration with Other Features

Combine Risk Analysis with other MindSnap features:

- Risk Analysis + Decision Tree: Transform risk assessment into decision frameworks

- Risk Analysis + SWOT: Convert risk analysis into strategic assessment

- Risk Analysis + Timeline: Add temporal dimension to risk assessment

- Risk Analysis + Cause and Effect: Understand risk relationships and dependencies

Real-World Risk Analysis Examples

Technology Implementation Risk Assessment

Input: Technology adoption strategy and implementation plan Risk Analysis Output:

- Technical Risks: System integration challenges, performance issues, compatibility problems

- Operational Risks: Business disruption, user adoption challenges, training requirements

- Financial Risks: Cost overruns, budget constraints, ROI uncertainty

- Security Risks: Data breaches, system vulnerabilities, compliance issues

- Mitigation Strategies: Phased implementation, pilot programs, comprehensive training

Market Entry Risk Analysis

Input: Market entry strategy and competitive analysis Risk Analysis Output:

- Market Risks: Economic volatility, regulatory changes, competitive response

- Operational Risks: Supply chain disruption, local market challenges, cultural barriers

- Financial Risks: Currency fluctuations, investment requirements, revenue uncertainty

- Reputation Risks: Brand damage, customer perception, stakeholder concerns

- Mitigation Strategies: Market research, local partnerships, phased entry approach

Investment Portfolio Risk Assessment

Input: Investment strategy and portfolio analysis Risk Analysis Output:

- Market Risks: Economic downturns, interest rate changes, inflation impact

- Credit Risks: Default risk, counterparty exposure, credit rating changes

- Liquidity Risks: Market liquidity, redemption pressures, cash flow needs

- Concentration Risks: Sector exposure, geographic concentration, asset class bias

- Mitigation Strategies: Diversification, hedging, liquidity management

Best Practices for Risk Analysis

Content Selection

- Choose comprehensive sources that thoroughly cover potential risks

- Include multiple perspectives for balanced risk assessment

- Select authoritative sources for accurate and reliable risk information

- Consider different scenarios and alternative outcomes

Risk Analysis Enhancement

- Validate risks against real-world experience and expert knowledge

- Quantify impacts when possible with data and metrics

- Prioritize risks based on impact and probability

- Develop specific mitigation strategies with clear action items

Practical Application

- Use for decision-making to understand potential outcomes

- Implement mitigation strategies to reduce risk exposure

- Monitor regularly to track risk changes and new threats

- Update assessments as conditions change and new information becomes available

Advanced Risk Analysis Workflows

Enterprise Risk Management System

- Generate comprehensive risk assessments from strategic and operational documents

- Categorize risks by business function and impact level

- Develop mitigation strategies with specific action plans and responsibilities

- Implement monitoring systems for ongoing risk tracking and management

- Review and update assessments regularly based on changing conditions

Project Risk Management Framework

- Create project risk assessments from project plans and requirements

- Identify project-specific risks and their potential impacts

- Develop mitigation plans with specific actions and timelines

- Monitor project risks throughout the project lifecycle

- Adapt strategies based on project progress and changing conditions

Investment Risk Management Program

- Generate investment risk analyses from market research and financial analysis

- Assess portfolio risks across different asset classes and strategies

- Develop risk management strategies including hedging and diversification

- Monitor portfolio risks with regular assessment and rebalancing

- Adjust strategies based on market conditions and risk tolerance

Measuring Risk Analysis Effectiveness

Quality Indicators

- Completeness: Are all significant risks identified and assessed?

- Accuracy: Are risk assessments accurate and based on reliable information?

- Actionability: Do risk assessments lead to effective mitigation strategies?

- Timeliness: Are risk assessments current and relevant?

Impact Metrics

- Risk Reduction: How effectively do mitigation strategies reduce risk exposure?

- Decision Quality: How do risk assessments improve decision outcomes?

- Loss Prevention: How much potential loss is prevented through risk management?

- Opportunity Capture: How well are opportunities identified and capitalized upon?

Troubleshooting Common Issues

Incomplete Risk Identification

If risk analyses miss important risks:

- Include more comprehensive source material

- Add expert knowledge and real-world experience

- Try different AI providers for varied risk identification

- Validate with risk management experts and practitioners

Unrealistic Risk Assessment

If risk assessments seem inaccurate:

- Include more recent and relevant source material

- Add quantitative data and metrics where possible

- Validate against historical data and expert judgment

- Consider different scenarios and alternative outcomes

Poor Mitigation Strategies

If mitigation strategies are unclear or impractical:

- Develop specific, actionable mitigation plans

- Include clear responsibilities and timelines

- Consider resource requirements and constraints

- Test strategies with stakeholders and experts

Conclusion

MindSnap's Risk Analysis feature transforms how you identify, assess, and manage risks by systematically analyzing potential threats and opportunities. Whether you're managing projects, making investment decisions, or planning business strategy, risk analysis helps you make informed decisions and protect your interests.

The combination of AI-powered analysis and visual mind mapping makes risk assessment accessible and actionable. Turn complex risk information into clear, structured analyses that guide decision-making and risk management.

Ready to manage risks more effectively? Download MindSnap and discover how risk analysis can enhance your decision-making and risk management capabilities.

Explore more MindSnap features: Cause and Effect | Decision Tree | All Features Guide